Preparing for Homeownership: Key Factors to Consider

Embarking on the journey to homeownership requires careful consideration of several critical factors. First and foremost, prospective home buyers should assess their financial readiness. This involves evaluating incomes, saving for a down payment, and budgeting for ongoing expenses such as property taxes, insurance, and maintenance costs. Understanding one’s financial situation lays the groundwork for making informed decisions about purchasing a home.

Another essential aspect of preparing for homeownership is familiarizing oneself with the various types of mortgages available. Options range from fixed-rate to adjustable-rate mortgages, each with its own advantages and disadvantages. Home buyers should evaluate their long-term financial goals in conjunction with these mortgage options to choose a product that aligns with their needs. It is advisable to consult with financial advisors or mortgage professionals to gain insights into the best fit based on individual circumstances.

Additionally, maintaining a good credit score is crucial when applying for a mortgage. Lenders often assess creditworthiness to determine eligibility and interest rates. Prospective buyers should periodically review their credit reports, address any discrepancies, and make efforts to improve their credit scores prior to embarking on the homebuying process. A strong credit score not only enhances mortgage options but also results in better terms, ultimately contributing to significant savings over the life of the loan.

Location is another pivotal aspect buyer consideration. It is important to evaluate neighborhoods based on proximity to work, schools, public transportation, amenities, and overall lifestyle preferences. Conducting market research provides valuable insights into property values and trends, enabling buyers to make educated choices based on their present and future aspirations. Furthermore, evaluating different property types—whether single-family homes, condominiums, or townhouses—ensures that potential homeowners select spaces that suit their needs, thus laying the foundation for a fulfilling life in their new home.

Post-Purchase Checklist: Ensuring a Smooth Transition into Your New Home

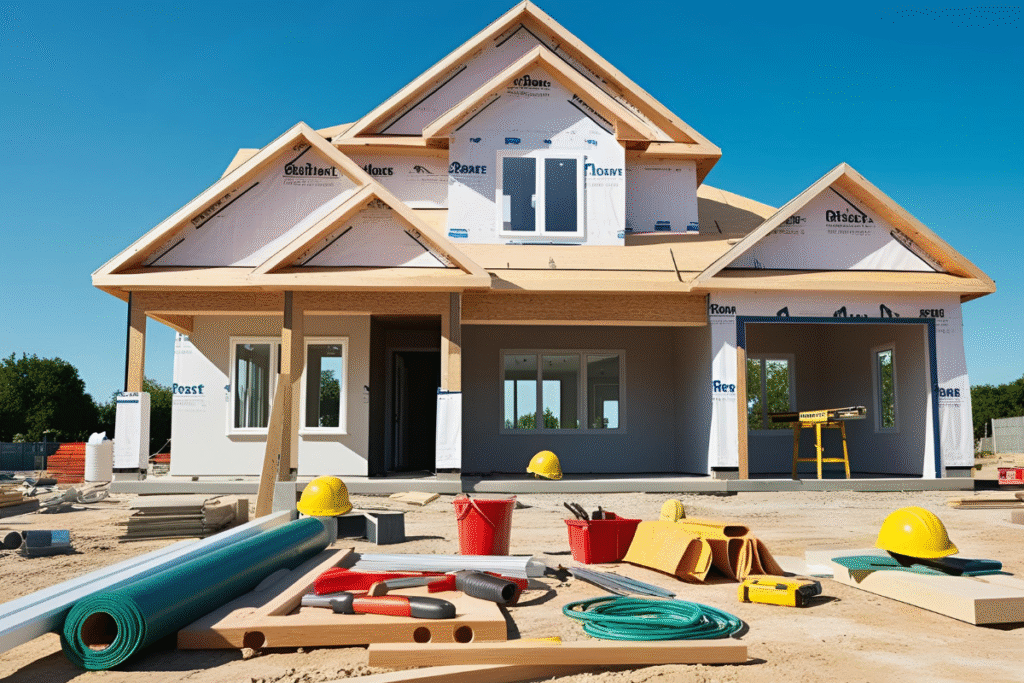

Acquiring a new home represents a significant milestone and a considerable investment. After the purchase is finalized, first-time homeowners should engage in a series of essential steps to ensure a smooth transition into their new residence. One of the primary actions to undertake is conducting a comprehensive home inspection prior to moving in. This inspection can reveal hidden issues that require immediate attention, allowing for necessary repairs to be addressed before they escalate into more significant, costly problems.

Additionally, it is crucial to establish utility services as soon as possible. Homeowners should schedule the connection of essential services such as electricity, water, gas, and internet to avoid inconveniences upon moving in. Promptly setting up these utilities will support moving logistics and create a comfortable living environment from day one.

Understanding the responsibilities that come with homeownership is vital. New homeowners need to familiarize themselves with their obligations, including property taxes and homeowner’s insurance. Consulting with professionals for these aspects can provide clarity and ensure compliance with local regulations. Awareness of these duties will facilitate better financial planning and ensure no surprises in the future.

Once settled in, personalizing the new home can significantly enhance the sense of belonging. Simple actions, such as painting walls or arranging furniture, can transform a house into a cozy haven that reflects one’s personality. In addition to personal touches, newcomers should consider engaging with their local community. Establishing good relationships with neighbors can create a supportive environment. Attending local events or participating in neighborhood groups also fosters connections and enriches the living experience.

By following this post-purchase checklist, first-time homeowners can significantly mitigate challenges associated with moving into a new residence, ensuring a seamless transition into their new community.